Paying Your Property Taxes

Property tax notices are mailed in late May each year. The due date for the 2024 Property Taxes was Tuesday, July 2, 2024. To avoid having to pay a penalty*, payment of property taxes must have been received by the Municipal Office by July 2, 2024.

If you have not received your property tax notice by late May or early June, please contact us at 604-886-2274 before the due date; it is the responsibility of the property owner to pay property taxes by the due date in order to avoid a penalty, whether or not a bill was received.

New owners who have not received a property tax notice are advised to contact the Finance Department.

How do I pay my taxes?

To get the answer to this and other frequently asked questions click here.

How do I claim my Home Owner Grant?

Go to the Home Owner Grant page.

Late Payments

*Payments received on or after July 3 will be subject to a 5% penalty fee. Payments received on after September 1 are subject to a further 5% penalty fee on all outstanding balances

View Your Property Tax Notice Online

Go paperless! Sign up for Citizen Service Cloud and start viewing your Property Tax Notice and property tax notices online.

Click here to link to Citizen Service Cloud/view your Property Tax Notice online.

Property Tax Deferment Program

The Province of BC administers the application and renewal process for the deferment of property taxes.

This means that the Town of Gibsons does not accept paper-based tax deferment applications or renewals. All property tax deferral applications must be submitted directly to the BC government.

Residential property owners can apply for property tax deferment on their principal residence online, quickly and easily. Owners are also able to auto-renew their application online. For information about how to defer your property taxes, please click here.

If you have any questions or require Property Tax Deferment support with these procedures or to discuss your deferment agreement, please contact the Property Tax Deferment office at 1.888.355.2700 (toll-free within Canada) or 250.387.0555 (outside Canada).

**Please note: if you do choose to defer your taxes, you are still required to claim your Homeowner Grant.

BC Assessment’s Role in Your Property Taxes

Property Taxes are calculated based on the assessed value of your property, which is provided by BC Assessment. The following helpful links and videos have been provided to us by BC Assessment and are a great place to start if you have questions about how the assessed value of your property affects your property taxes.

BC Assessment web links:

Property Assessments and Property Taxes: A not-so complicated relationship

BC Assessment Videos:

Your property value change and property taxes

Understanding Property Assessments & Property Taxes

How are property taxes calculated?

How are taxes calculated if assessment values change?

If you have questions about your assessment, please contact BC Assessment directly at 1-866-825-8322 or visit their website.

The Role of Local Government in Your Property Taxes

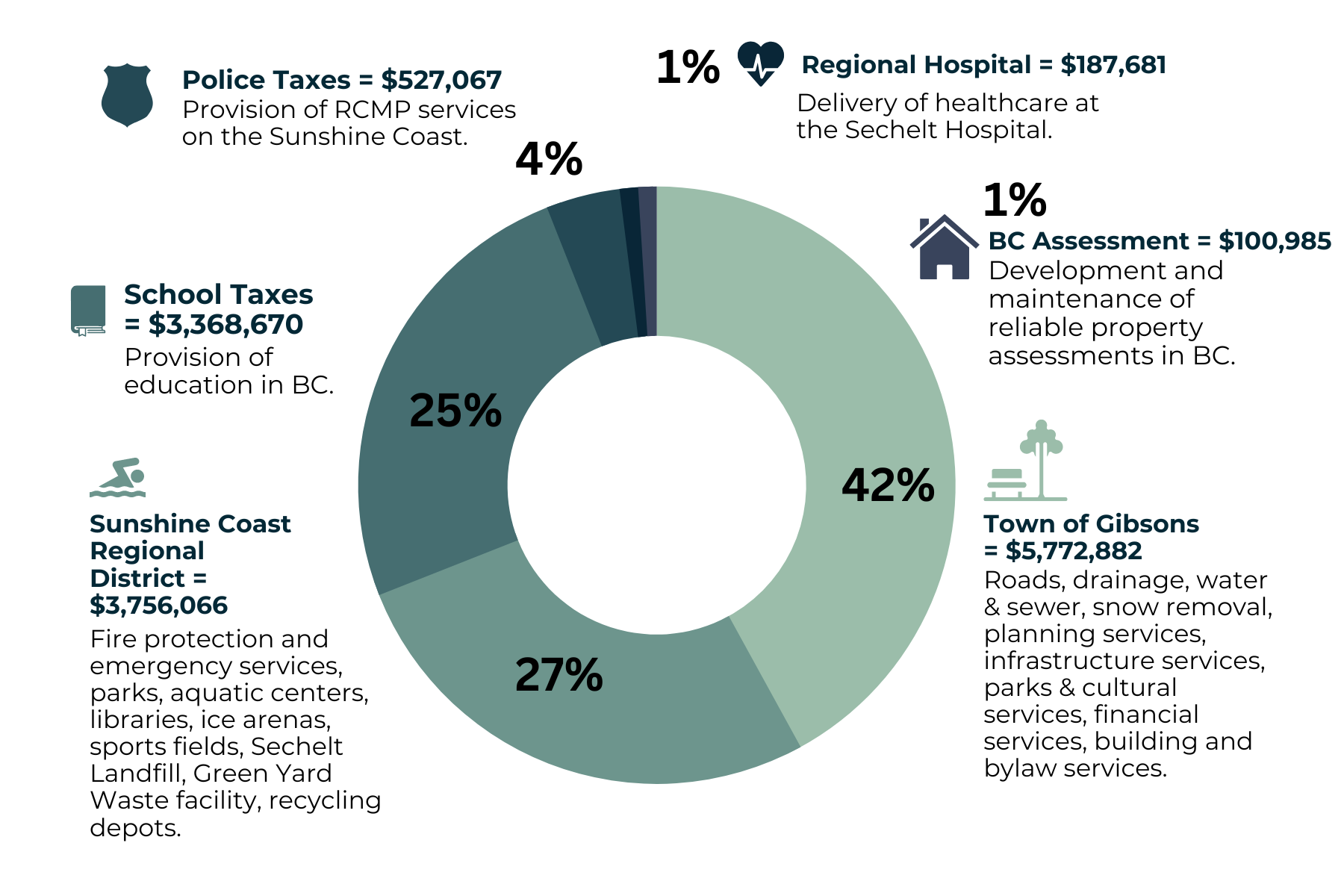

Your property tax notice includes municipal taxes and levies from the Sunshine Coast Regional District and School District No. 46. The Town does not control rates for these taxing authorities, but acts as the collector on their behalf. Gibsons Council has control over the rate setting of municipal taxes only.

The graphic below shows that the Town of Gibsons retains just 42% of the total property taxes it collects. The balance is distributed to five other governmental agencies, which each determine their own taxation requirements.

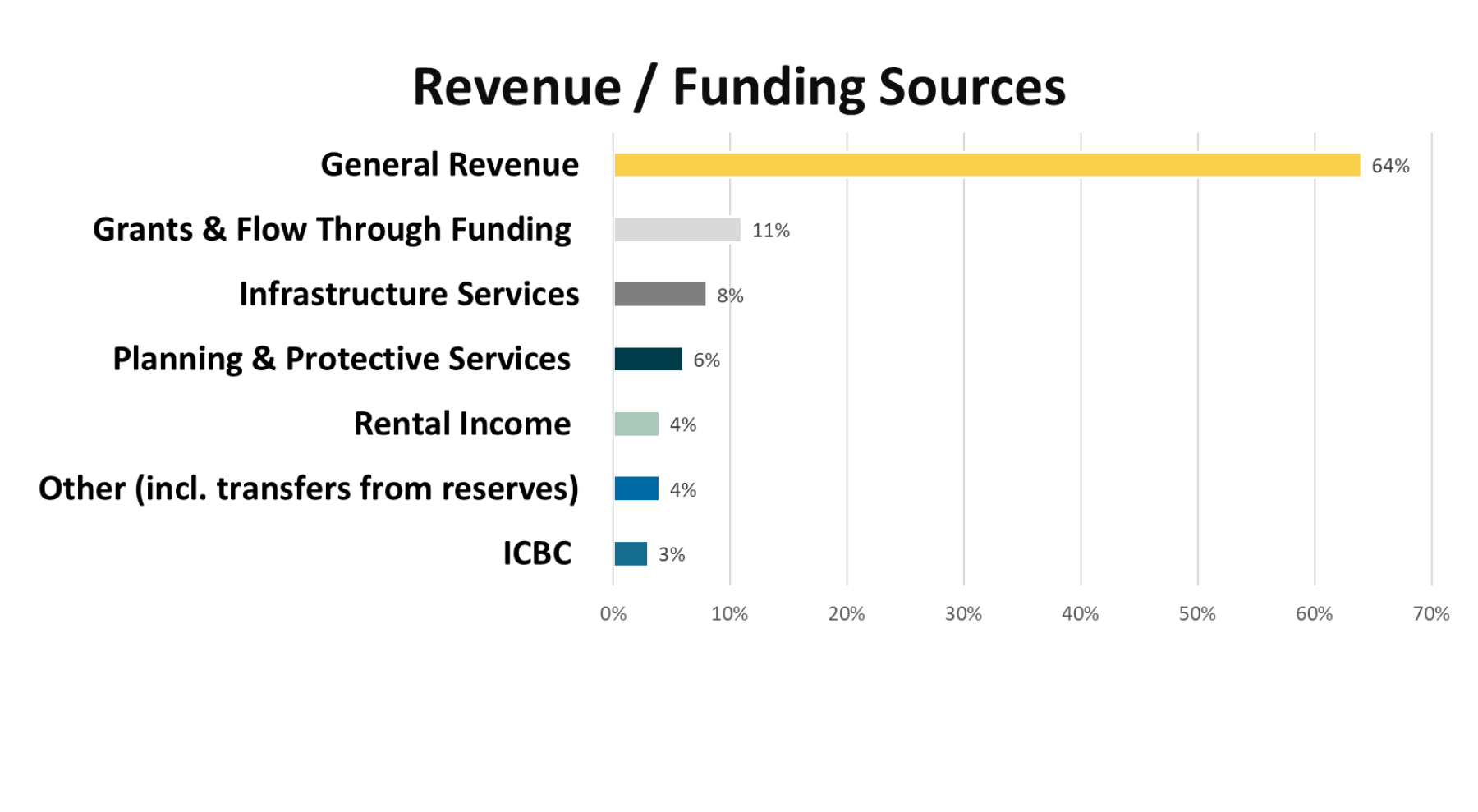

Where does the funding for the Town of Gibsons’ 2023 Budget come from?

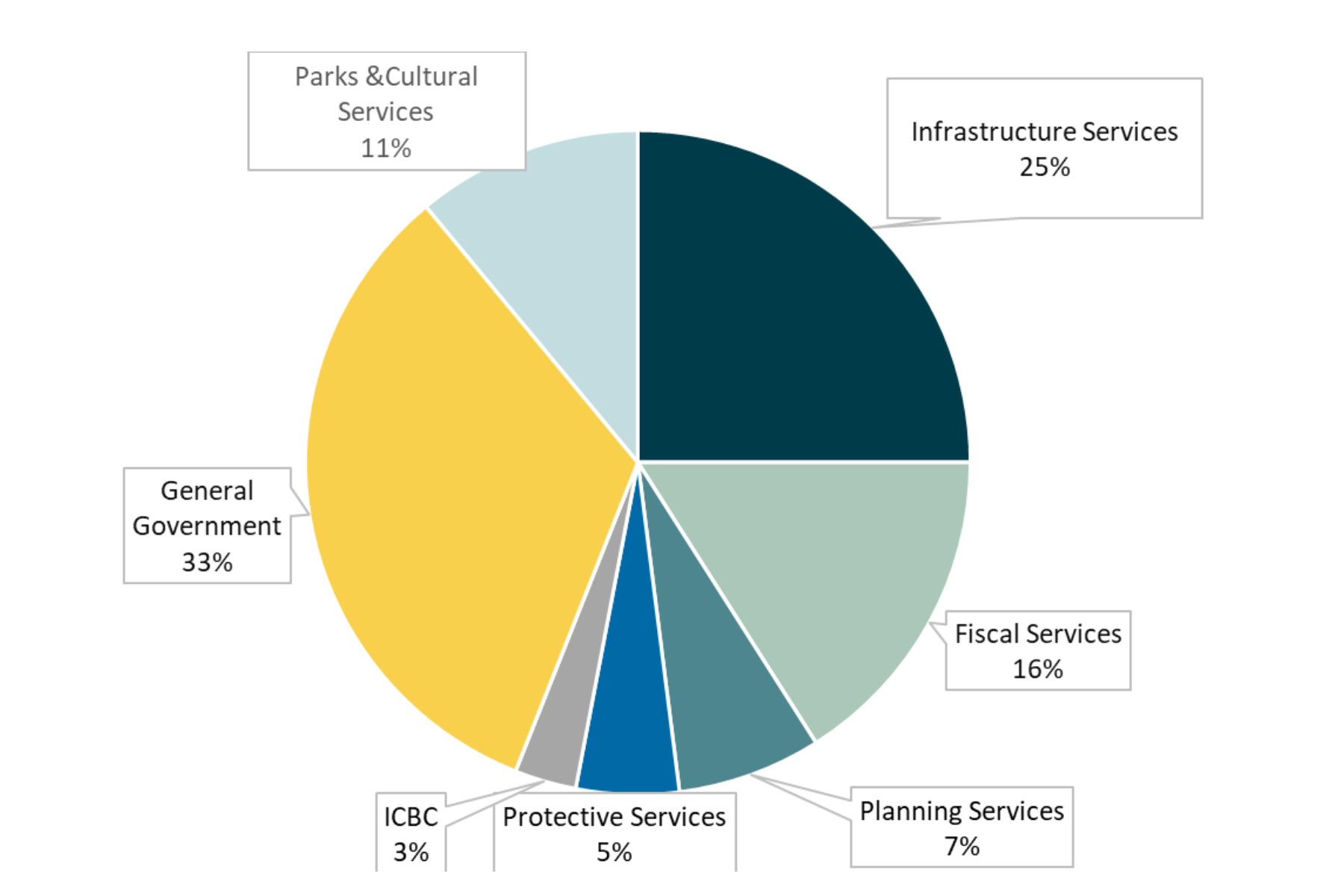

Where does the funding for the Town of Gibsons’ 2023 Budget go?

The operating revenue collected by the Town is used to fund a full range of municipal services, including water, sanitary sewer, infrastructure maintenance, planning services (such as issuing building and development permits) and the staffing required to deliver these services.

Property Tax Certificates:

Are you a lawyer or Notary Public looking for a Property Tax Certificate? Our Tax Certificates are conveniently available online through:

- myLTSA Enterprise:If you have an account, log in and from the main menu, select Service Providers and Order Tax Certificates. For more information about myLTSA or to become a customer, visit www.ltsa.ca

- APIC:If you prefer to pay for the tax certificate by credit card, please visit www.apicanada.com to open an account and order your Tax Certificate.

Annual Tax Sale:

In accordance with the Local Government Act, the Town of Gibsons is required to conduct an annual tax sale on the last Monday in September by offering for sale by public auction each parcel of real property on which taxes are delinquent.